Freddie Mac Sees Low Rates Extending Through 2020

Freddie Mac Sees Low Rates Extending Through 2020

Jul 31 2019, 10:28AM

The housing market has been looking slightly better over the last few month and Freddie Mac July economic report reflects that fact. They also maintain a fairly rosy picture of the economy as a whole.

They note that the 30-year fixed-rate mortgages (FRM) dipped below 4.0 percent at the end of May and has remained there "amid concerns over trade disputes, a possible economic slowdown, and market anticipation of a Federal Reserve interest rate cut." This has caused a spike in mortgage applications for both purchase and refinancing and they predict that low rates, along with a thriving labor market, will help sustain the housing market, not just short term, but for at least the next year and a half.

They have, in fact, revised down their quarterly forecasts for mortgage rates over that period, forecasting an annual rate for the 30-year fixed-rate mortgage of 4.1 percent this year and an even lower 4.0 percent in 2020

They note that the 30-year fixed-rate mortgages (FRM) dipped below 4.0 percent at the end of May and has remained there "amid concerns over trade disputes, a possible economic slowdown, and market anticipation of a Federal Reserve interest rate cut." This has caused a spike in mortgage applications for both purchase and refinancing and they predict that low rates, along with a thriving labor market, will help sustain the housing market, not just short term, but for at least the next year and a half.

They have, in fact, revised down their quarterly forecasts for mortgage rates over that period, forecasting an annual rate for the 30-year fixed-rate mortgage of 4.1 percent this year and an even lower 4.0 percent in 2020

http://www.mortgagenewsdaily.com/07312019_freddie_mac_forecast.asp

Mortgage rates forecast for August 2019

Mortgage rates are on the cusp of a new era, ushered in by a rare action by the Fed: a rate cut during an economic boom.

Typically, the Fed slashes rates in times of recession, as it did in 2008, which is the last time we saw any kind of cut at all.

For the first time in nearly 11 years, though, the Fed is expected to cut rates on July 31.

This could make August quite interesting for mortgage rates.

Already near 3-year lows, rates could drop even lower. But can they descend further than the ridiculously low 3.75% 30-year fixed that Freddie Mac is already reporting? Some think so.

This could be the opportunity that home buyers and refinancing home owners were waiting for.

Ready to capture one of history’s lowest rates? August could be your month.

Predictions for August

August will be a wild ride for mortgage rates. Market-moving news will leave rates different than they were in July. The only question is, will they be more or less advantageous for mortgage shoppers?

Skip to:

- Mortgage rate predictions

- Federal Reserve moves

- Featured lenders this month

- Will rates keep dropping?

- Mortgage rate trends

- Advice for August

- Conventional, FHA, VA, and USDA rates

- Economic calendar

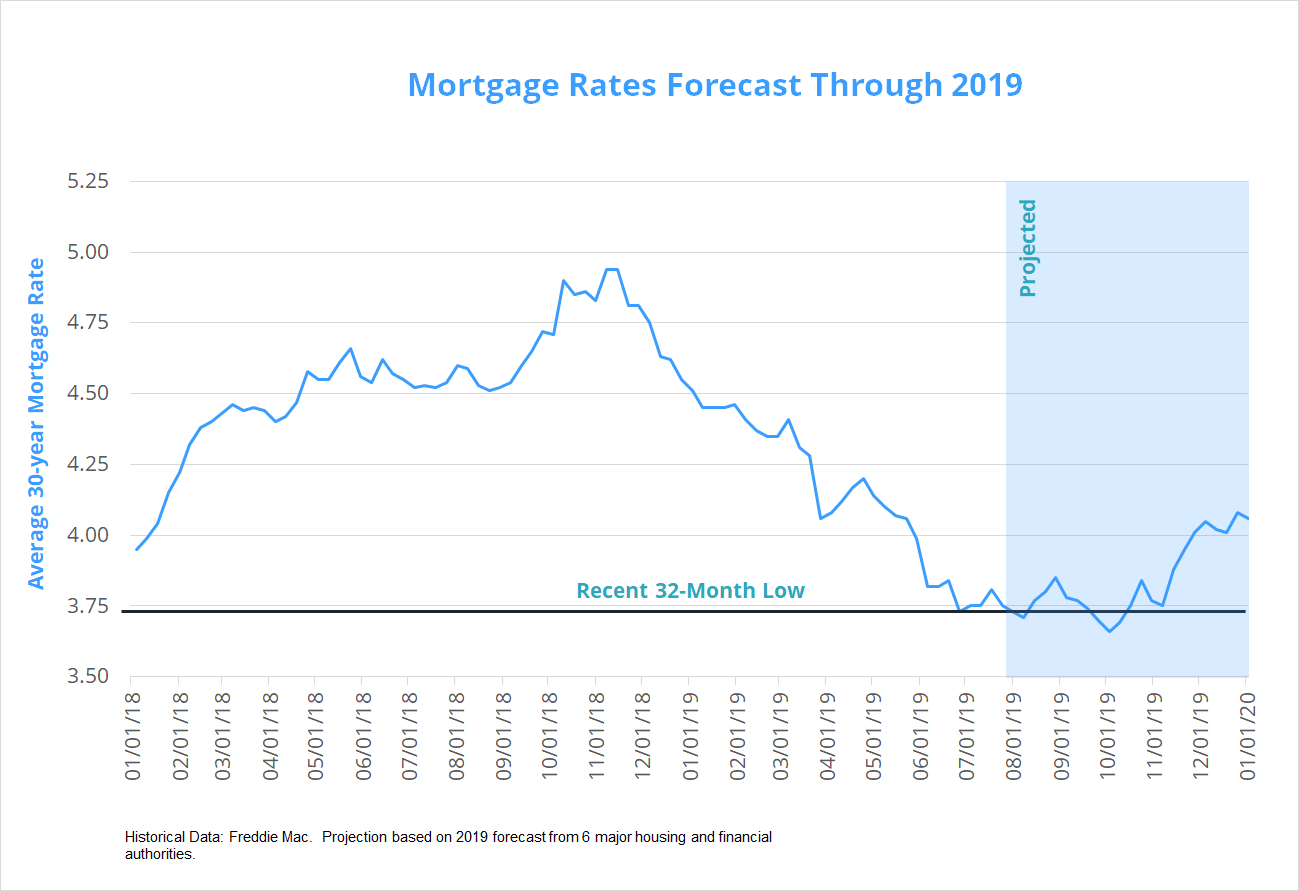

Forecasts for 2019 put rates somewhere around 4.4% by the end of the year. That’s down from forecasts earlier in the year that called for rates in the 5s.

The funny thing is, though, that rates have been dropping since late 2018. Now, it appears rate increases could be much more subdued than first thought, if rates increase at all.

Been looking for a good rate on a refinance or home purchase? Now might be the time to lock.

Mortgage agency Freddie Mac slashes its rate forecast for 2019-2020

Freddie Mac is one of the leading sources for rate forecasts in the U.S.

So when it cuts its rate prediction by 1%, consumers should pay attention.

As recently as late-2018, the agency predicted 30-year mortgage rates at 5.1% for 2019. The group just cut that prediction to 4.1%.

As a home buyer, it could mean buying four bedrooms instead of three, or selecting the neighborhood you really wanted.

What’s more, it foresees rates going up to just 4.2% in 2020.

This is significant. A 1% lower rate on a $350,000 mortgage translates to a savings of $200 per month. As a home buyer, it could mean buying four bedrooms instead of three, or selecting the neighborhood you really wanted.

As a refinance candidate, it means finally having breathing room in your monthly budget.

With current rates near 4%, and major agencies predicting they’ll stay that way, it makes sense to seriously consider a home purchase or refinance in the next few months.

August: First Fed rate cut since December 2008

The Federal reserve uses “levers” to adjust economic performance in the U.S. One of those levers is the federal funds rate.

It’s the rate at which banks can lend each other money, but it affects home equity lines, credit card rates, and even mortgage rates, although indirectly.

On July 31, the Fed is expected to cut rates for the first time since December 2008. Lackluster economic data has combined with pressure from President Trump to cut rates.

Now, the Fed will do something thought impossible earlier this year: provide stimulus to an already-hot economy, a pre-emptive strike to keep this bull run going.

The move could have profound effects for mortgage shoppers. It’s been nearly 11 years since the last rate cut and no one knows exactly what will happen this time.

It might usher in a new era for mortgage rate shoppers.

Rates are already in the high 3s accordging to Freddie Mac. Could they fall to the high 2s? No one knows, but one commentator is calling for the lowest rates ever.

Talk about paradigm shifts.

Just months ago, everyone was predicting rates in the 5s. That would have been a tough pill to swallow for refinance and home purchase candidates alike.

Just months ago, everyone was predicting rates in the 5s.

With rates in the 3s, and the possibility of even lower rates, a whole new world is opened up to those seeking home financing.

But should mortgage consumers wait until then to lock in a rate? No. Markets are forward-looking, so many believe that mortgage rates have already fallen to fresh lows in anticipation of the new Fed paradigm.

Comments

Post a Comment